Sometimes, life throws unexpected financial challenges our way. Whether it’s a medical emergency, home renovation, or a dream business plan that needs funding, we often turn to banks or financial institutions for a loan. But what if you’re running from bank to bank and still facing rejection? It can be frustrating and emotionally draining. The real reason behind this silent rejection might be something you’ve overlooked: your CIBIL Score.

What Exactly Is a CIBIL Score

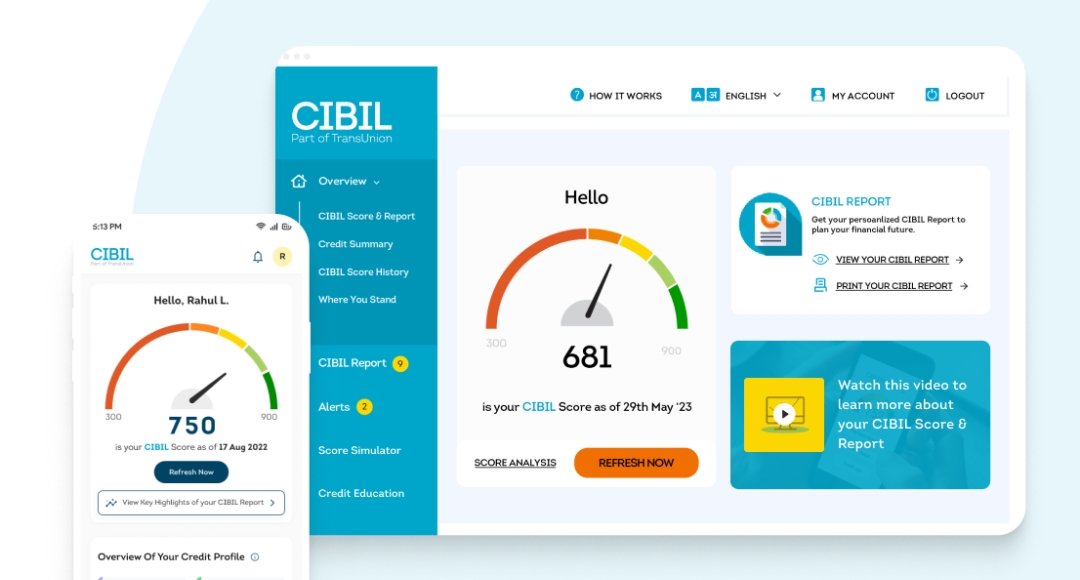

The CIBIL Score is a three-digit number that tells lenders how trustworthy you are when it comes to repaying money. In simple words, it reflects your credit history, including all the loans you’ve taken and how well you’ve repaid them. This number usually ranges from 300 to 900, and the closer you are to 900, the better your chances of getting a loan approved.

Anything above 700 is generally considered a good score. But if your score is below 700, most banks may either reject your loan application or offer it at a higher interest rate. In short, your financial trustworthiness is judged by this small yet powerful number.

How Can You Check Your CIBIL Score

Thanks to the digital age, checking your CIBIL score is easier than ever. You can visit the official CIBIL website and get your score by paying a small fee. Alternatively, many digital payment platforms and financial apps offer a free credit score check service. Knowing your score before applying for a loan helps you understand your chances of approval and also gives you an idea of the interest rate you might be offered.

What’s Included in Your CIBIL Score

Your CIBIL report doesn’t just show a number. It holds a mirror to your financial behaviour. It includes:

- Your personal and contact details

- A list of all your past and current loans

- Your credit card usage and repayment history

- Details of any loan inquiries made by banks or other institutions

- Information about whether you’ve acted as a guarantor for someone else’s loan

All this information helps lenders decide if you’re a safe bet.

Can a Low CIBIL Score Be Fixed

Yes, it can, but it takes time and discipline. If your score is between 650 and 700, it might take anywhere from 4 to 12 months to cross 750, provided you start taking the right steps. If it’s below 650, it could take more than a year to reach a score where banks feel confident lending to you.

Start by clearing all your outstanding dues, whether it’s a loan or a credit card bill. Then, begin using your credit card for small purchases and make sure you repay the full amount within the same billing cycle. This shows lenders that you are responsible with credit.

And if you’re still struggling to get a loan due to a low score, consider approaching RBI-approved digital loan services. These platforms often offer small loans even to people with poor credit histories. Repaying these loans on time can gradually improve your score.

A low CIBIL score is not the end of the road. It’s just a sign that your financial behaviour needs a little tuning. With patience, awareness, and responsible actions, your score can and will improve. Don’t lose hope. Your dream home, business, or emergency support is still possible; you just need to take the right steps today.

Also Read

Why a 750+ CIBIL Score is the Golden Key to Your Financial Dreams

No Market Risk, Just Pure Returns ₹2 Lakh in Post Office FD Gives ₹29,776 Profit

Gold Prices Hit New Highs: What You Need to Know This Wedding Season