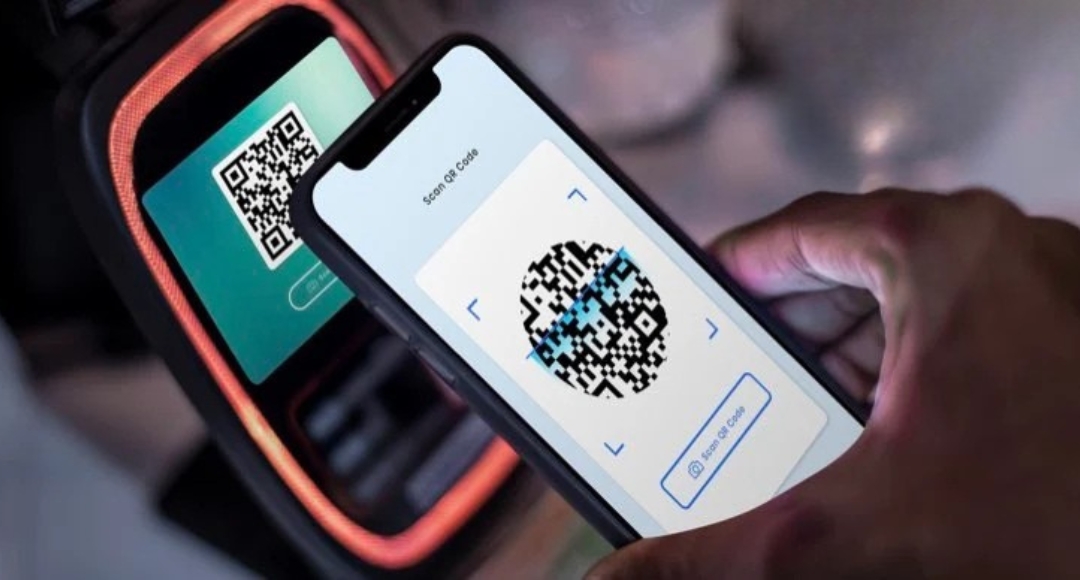

UPI Payments: Imagine sending money to a friend or paying for your groceries with a single tap on your phone, something we all do every day using UPI. Now, imagine being charged extra just for that convenience. Yes, that’s the concern many Indians are facing as reports suggest the government is considering levying Goods and Services Tax (GST) on UPI transactions above ₹2,000.

Digital payments have become a part of our everyday lives. Whether it’s buying essentials online, transferring money to loved ones, or even paying for a quick coffee, UPI has made everything seamless and fast. But now, this very convenience might come with an added cost.

GST on UPI: What’s the Proposal

According to recent media reports, the central government is reviewing a proposal that would bring certain UPI transactions under the GST umbrella. Specifically, if the value of a single UPI payment exceeds ₹2,000, it may attract an 18% GST, the standard rate for most digital services in India.

This proposal, if implemented, would affect both peer-to-peer transfers and merchant payments. That means whether you’re sending money to your friend or paying a vendor, your high-value UPI transaction could be taxed.

Why Is the Government Considering This Move

The government’s main goal, sources say, is to improve tax compliance and ensure that digital transactions are properly recorded within the formal economy. With India seeing a surge in digital payments, it’s become essential to make sure that every rupee moving through digital channels is accounted for.

Interestingly, GST collections in India are already showing strong growth. In February 2025 alone, the country’s GST revenue rose by 9.1%, hitting ₹1.84 lakh crore. This includes:

- ₹35,204 crore from Central GST

- ₹43,704 crore from State GST

- ₹90,870 crore from Integrated GST

- ₹13,868 crore from Compensation Cess

Even though the GST numbers are promising, the government appears keen on tapping into the booming digital payment space to further boost its collections.

How Will This Impact You

If you often make UPI payments over ₹2,000, this potential change could hit your wallet. An 18% GST on such transactions would mean paying more for the same service that was once free and easy.

While the exact details and the implementation timeline are still under wraps, the very thought of taxing UPI transactions has raised concerns among regular users and small businesses alike.

The fear is not just about the extra cost, but also about slowing down the momentum of India’s digital payment revolution, which has been a global success story so far.

What’s Next

As of now, no official announcement or date for this proposed GST change has been confirmed. But the fact that it is under active review signals that changes could be coming soon.

Whether this move would help the economy or burden common users is a debate that will unfold in the coming weeks. Until then, users are advised to stay informed and keep an eye on further government updates.

Disclaimer: The information in this article is based on media reports and official data available as of April 2025. The GST proposal on UPI transactions is still under review and has not been officially implemented. Readers are encouraged to follow official government notifications for the latest updates.

Also Read

Gold Prices Soar to New Highs Amid Global Trade War Tensions

Say Goodbye to Cheque Bounce Loopholes Govt and RBI’s Tough New Policy

8th Pay Commission How much salary can increase, and how much increased before