In the present digital world, while electronic transactions such as UPI and online transfers are common, the humble cheque still holds great value. Be it a large purchase, legal settlement, or just a preferred mode of payment, it is important for individuals and businesses alike to understand the different types of cheques. This article will delve into the nuances of various cheques and provide a comprehensive guide on how to navigate this traditional yet essential financial instrument.

1. Bearer Cheques: Cash in Hand

A bearer cheque is essentially a “payable to bearer” instrument. This means it can be encashed by anyone who presents it at the bank, regardless of their name. While convenient for immediate cash withdrawals, bearer cheques carry a higher risk of theft or misuse compared to other types.

2. Order Cheques: Safety and Control

There is increased safety in the order cheques, also referred to as “payable to order” cheques. Here, the cheque is specifically given to a person or organisation. The name of the payee is clearly shown in the cheque, and they can alone or through their agent be able to cash it. Such a requirement provides a limitation and reduces the chances of fraudulent transactions.

3. Crossed Cheques: Additional Safety

Open cheques bear two parallel lines across the left top corner, usually having the words “a/c payee” written over it. This means that the amount in the cheque must be credited to the payee’s account in the bank. No cash withdrawal is possible across the counter. Open cheques are safer as less possibility of getting into wrong hands and misused.

4. Open Cheques: Convenience and Flexibility

Open cheques, also called uncrossed cheques, do not have the crossed lines. Anyone can present them at the bank and get them encashed. This flexibility makes them handy for immediate cash withdrawal or depositing in some other account. However, open cheques are considered less secure than crossed cheques.

5. Post-Dated Cheques: Delayed Payments

A post-dated cheque bears a future date. It can be presented to the bank only after the specified date. This type of cheque is useful for delayed payments, such as rent or installments, ensuring that funds are available on the agreed-upon date.

6. Stale Cheques: Time-Bound Validity

A stale cheque is a cheque that has crossed the time limit set for its validity. At present, in India, the validity of cheques is three months from the date of issue. After the said period, the cheque becomes invalid and cannot be encashed.

7. Traveller’s Cheques: International Convenience

Traveller’s cheques are a form of internationally accepted currency. Issued by banks in various denominations, it is the safe and easy way of carrying large amounts of money during travel without having to carry large sums of cash. Traveller’s cheques usually have no expiry date, so that the same may be used after a trip for encashing.

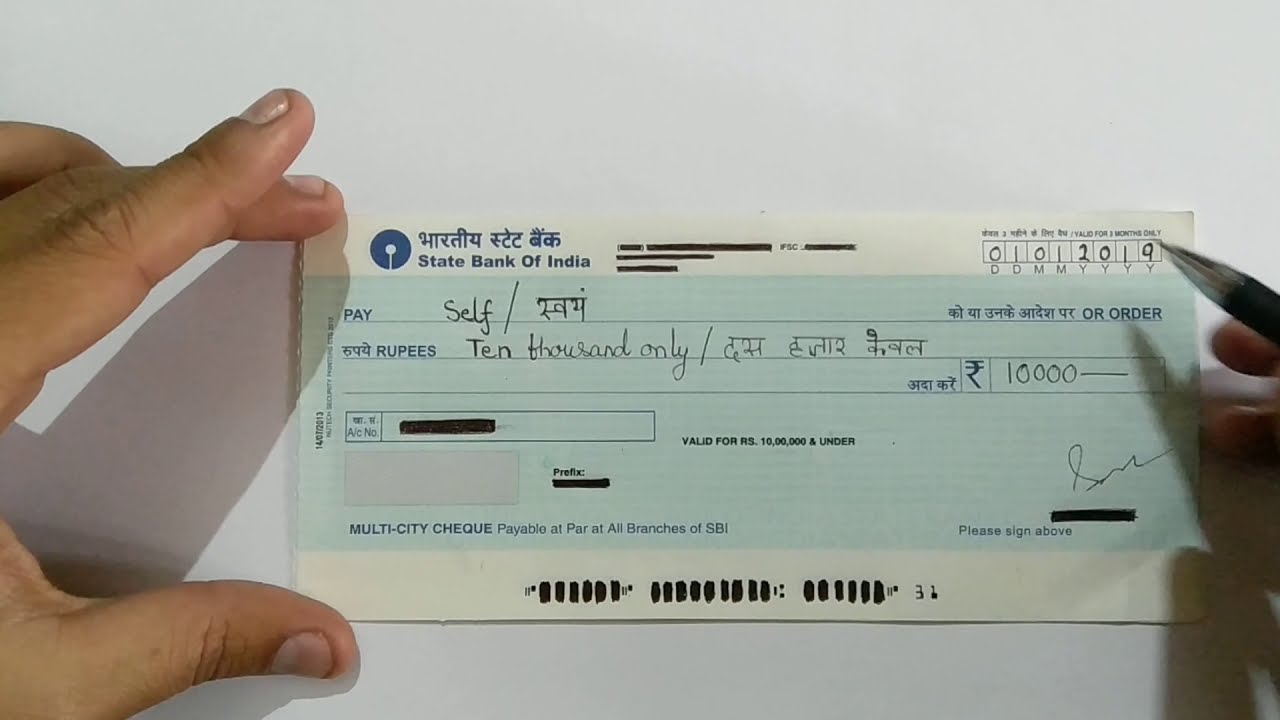

8. Self Cheques: Drawing Cash on your own behalf

A self-cheque is drawn by a person to himself. The word “self” is written in the payee’s name field. This cheque is widely used for withdrawing cash from one’s own bank account.

9. Banker’s Cheques: Cheques that are guaranteed payments

A banker’s cheque is a cheque issued by a bank on behalf of the account holder. It guarantees payment to the recipient. The bank verifies the account holder’s funds and assumes responsibility for honoring the cheque. Banker’s cheques are often preferred for high-value transactions or when immediate payment is crucial.

Conclusion

Understanding the different kinds of cheques is really important for anyone using bank services. The choice of the right cheque for the respective transaction will help individuals and companies provide better security, easy transactions, and smooth flow in financial transactions.

Read More:-

Anganwadi and ASHA Workers Deserve a Fair Wage: A Call for Better Remuneration

SIP vs RD: Which is Better for a 5-Year, ₹5,000/Month Investment?

Unraveling the Mystery: Why Stock Markets Crash

Good News for Euro-Bound Travelers: Air India Makes it Easier