Do you want an investment that could give you high returns in the near future? If you are willing to take a little bit of risk, the LIC Nivesh Plus Plan might be the best one for you. It is a Unit Linked Insurance Plan (ULIP) from the Life Insurance Corporation of India (LIC), where you make one-time premium payments. Your money then gets invested in the stock market with a promise to yield high returns.

How Does It Work?

The LIC Nivesh Plus Plan is a single premium payment ULIP. That means you pay the whole premium amount upfront, and your money gets invested in different funds. Whichever funds you opt for determine what amount of risk you’re taking on. The more you take on, the more the return may be. The reverse goes for potentially losing money however.

Key Features and Benefits

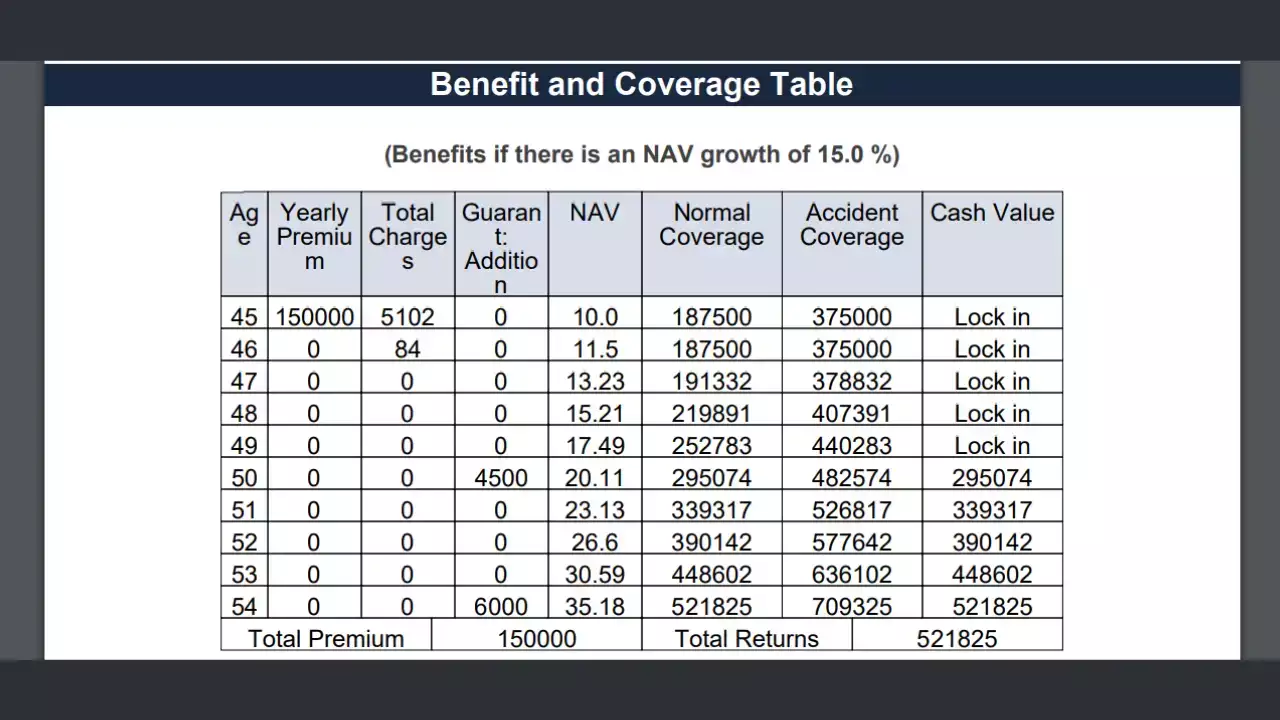

Along with the investment aspect, the plan also offers life and accidental cover. The coverage amount increases with time as your investment grows. Flexibility: You can invest in one of four funds – Growth, Balanced, Secure, or Bond. The risk level for each fund is different, so you have the flexibility to set up your plan according to your specific requirements and the potential to absorb the risk.

Potential to earn a very high return multiple: In five years, you could be double your investment if you choose the Growth fund, which, at face value, is the riskiest of the funds. This is assuming 15% annual growth rate in the Net Asset Value of the fund. Nothing is guaranteed, and it depends on how the stock market is performing.

Risk Understanding

Although the LIC Nivesh Plus Plan is promising returns, it’s of great importance to know that investment in the stock market is risky. Therefore, your investment may gain or reduce in value. The higher the risk you take, the higher will be your returns.

Investment Options

Growth Fund: It gives the highest return but with the highest risk. Balanced Fund: This is the investment made in equity and debt instruments collectively, having a moderate level of risks as well as returns. Secure Fund: This will be an entirely debt instruments kind of investment. It provides the lowest level of risk. Along with that, the overall potential returns for you will be low as well.

Bond Fund: It invests exclusively in bonds. These provide the lowest level of risks and offer the lowest potential returns.

Do You Need the LIC Nivesh Plus Plan?

Invest in LIC Nivesh Plus only when you have identified what your financial goals, tolerance to risk, and your time horizon are. The more you are ready for risking more and expecting high return the better this plan would serve the purpose. However it’s not for risk avers.

Disclaimer: The article is for informational purposes only and shall not be construed as an investment advisory. Any investment decisions should be consulted with a qualified financial advisor prior to making such decisions.

Read More :-

Get a Sokudo Acute Electric Scooter for Just ₹9,000! Enjoy a 150km Range

Tata Safari EV to Launch Soon in India 500km Range and Luxurious Interior

Bring Home a 200km Range Ather 450X Electric Scooter for an Incredible ₹13,000

120km Range and Advanced Features With Zelio Gracy i for Under ₹55,000